Why the future of automation is being written by the automotive industry

Automotive manufacturing has become the world’s most demanding proving ground for industrial automation. The scale, variability, and economic pressure of modern vehicle production have pushed automation systems beyond static, pre-programmed execution and toward real-time, adaptive operation. What succeeds in automotive plants increasingly defines what becomes viable across manufacturing as a whole.

This is not a matter of prestige or historical leadership. It is the result of structural forces that place automotive manufacturers at the frontier of automation complexity.

Automotive concentrates the hardest constraints in manufacturing

Few industries combine the same level of pressure across cost, quality, throughput, and flexibility. According to the AMS / ABB Automotive Manufacturing Outlook Survey 2025, automotive leaders identify cost pressures, labor and skills shortages, tariffs, and supply-chain disruption as simultaneous and compounding challenges. These pressures exist elsewhere, but nowhere are they felt with such immediacy at scale.

At the same time, automotive production is experiencing accelerating complexity. Faster product lifecycles, mixed-model production, electrification, and growing powertrain variety all contribute to a manufacturing environment where repeatability cannot be assumed. The same survey shows that manufacturers are responding by increasing investment in automation and robotics while shifting toward more flexible and modular production strategies.

Automation that cannot absorb variability does not survive long under these conditions. Systems are expected to perform continuously, across shifts, models, and plants, with minimal tolerance for downtime or manual intervention.

Real factories reward automation that adapts in real time

Automotive plants have always been early adopters of robotics. What has changed is the nature of the problems robots are asked to solve. Increasingly, tasks are performed on moving lines, with parts presented in semi-structured or unstructured ways, and with limited opportunity to redesign the physical environment.

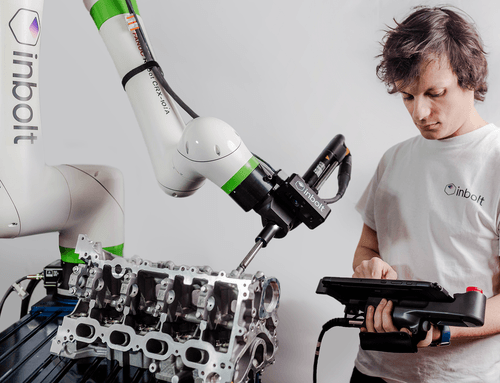

Examples from Stellantis production sites illustrate this shift clearly. Vision-guided robots are deployed for depalletizing, bin picking, tightening on continuous moving lines, and de-racking operations where part position varies cycle to cycle. These applications rely on real-time 3D localization and continuous trajectory adaptation rather than fixed reference points or mechanical indexing. Across multiple Stellantis plants, this approach has enabled reliable automation without heavy fixtures, encoder systems, or extensive line re-engineering, while delivering measurable improvements in accuracy, uptime, and return on investment.

The lesson is structural. Automotive production environments reward automation architectures that integrate perception, control, and motion into a single real-time loop. Systems that operate on static assumptions struggle to maintain performance as variability accumulates.

Automotive sets the bar for production-grade intelligence

The automotive industry’s influence extends beyond robotics hardware. ABB’s survey highlights software, digitalization, simulation, and digital twins as among the most significant areas of automotive manufacturing over the next five years, alongside automation and robotics. This emphasis reflects a broader transition toward data-driven, software-defined production systems.

In practice, automotive plants increasingly expect digital representations to remain synchronized with physical reality. CAD models, simulation environments, and robot programs are valuable insofar as they connect directly to live execution. The gap between digital intent and physical behavior is treated as an engineering problem to be closed, not accepted.

This expectation is shaping how automation systems are designed. Vision systems are mounted directly on robots to align perception with action. Localization is performed continuously rather than once per cycle. Motion is adjusted dynamically based on live inputs rather than precomputed paths. These design choices emerge from production necessity, not theoretical preference.

What works in automotive scales outward

Historically, manufacturing innovations validated in automotive plants have propagated to other sectors. Lean manufacturing, just-in-time production, and large-scale robotics deployment all followed this trajectory. The same pattern is now visible with adaptive automation.

The automotive sector’s combination of volume, diversity, and operational rigor forces technologies to mature quickly. Solutions that succeed there demonstrate resilience across lighting conditions, part variation, wear, and operational drift. As a result, they translate effectively to adjacent industries facing rising variability, such as white goods, electronics, and logistics.

This is reflected in survey data showing that investment in automation and robotics is strongest among OEMs, technology specialists, and Tier 1 suppliers, while adoption upstream remains more uneven. Automotive continues to act as the reference environment where automation systems are stress-tested before broader diffusion.

Automotive defines the next generation of automation

The future of industrial automation is being shaped less by abstract capability and more by operational credibility. Automotive manufacturing provides the environment where that credibility is earned. Its plants demand automation that functions continuously, adapts instantly, and integrates seamlessly with production realities.

As factories across industries face similar pressures—labor scarcity, cost volatility, customization, and speed—automation strategies validated in automotive will increasingly set expectations elsewhere. In that sense, automotive does not merely adopt the future of automation, it defines it.

Explore more from Inbolt

Access similar articles, use cases, and resources to see how Inbolt drives intelligent automation worldwide.

Reliable 3D Tracking in Any Lighting Condition

The Circular Factory - How Physical AI Is Enabling Sustainable Manufacturing

NVIDIA & UR join forces with Inbolt for intelligent automation

KUKA robots just got eyes: Inbolt integration is here

Albane Dersy named one of “10 women shaping the future of robotics in 2025”

Want to Sound Smart About Vision‑Guidance for Robots?

Inbolt Joins NVIDIA Inception to Accelerate AI-Driven Automation